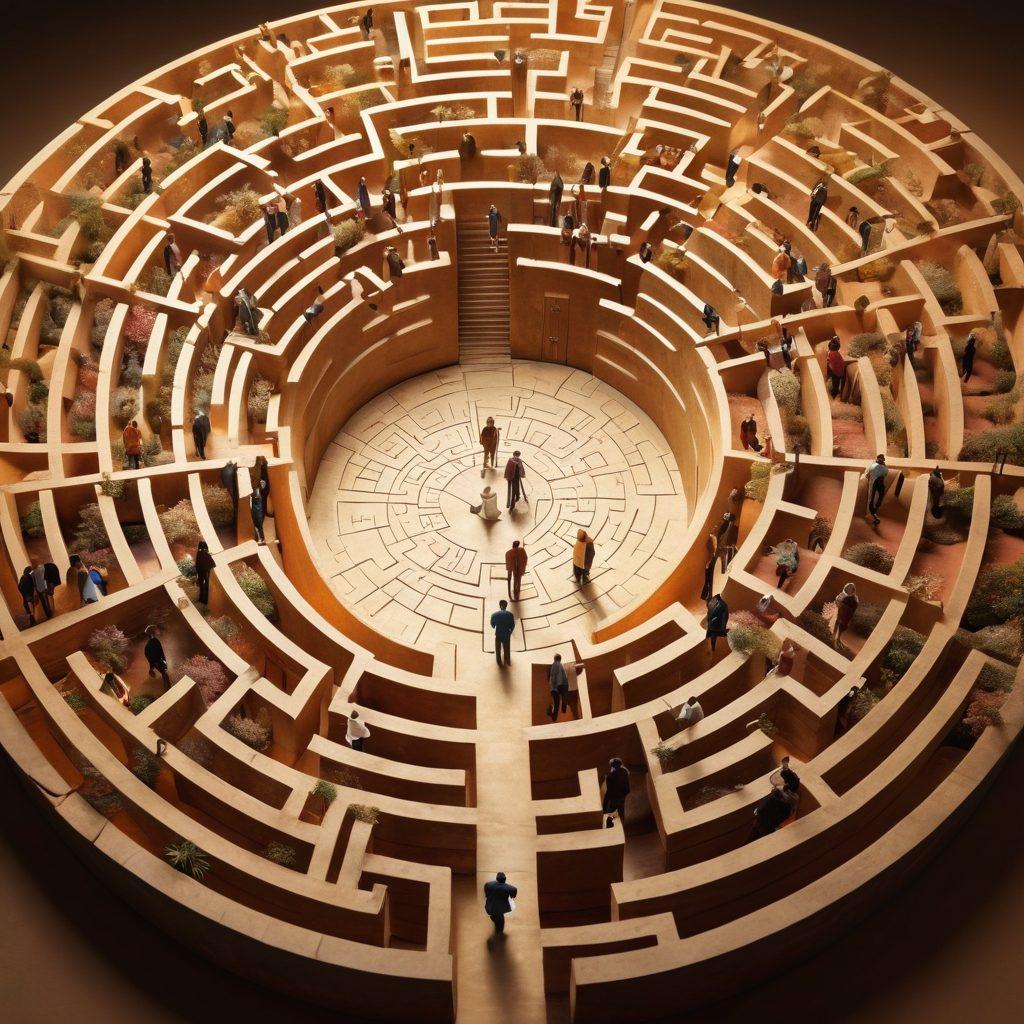

Navigating the Insurance Maze: Your Guide to Coverage, Claims, and Financial Security

Imagine standing at the crossroads of your financial future, cash flowing in one direction while potential liabilities veer ominously in another. Navigating the thick jungle of insurance policies can feel like a daunting endeavor, but it’s a journey worth taking. After all, this is about securing not just assets but peace of mind. In this blog, we will unlock the secrets of insurance policies, providing you with a clear, step-by-step approach to understanding coverage, claims, and ultimately achieving financial security.

From health insurance to auto insurance and home insurance, the spectrum of choices we face can be overwhelming. According to a recent study, nearly 80% of policyholders admit to being confused about their coverage options. If you find yourself questioning terms like 'premium' or the exact 'benefits' of a term insurance policy, rest assured—you’re not alone! This blog is designed to peel back the layers of uncertainty, offering actionable insights that can uplift your understanding and confidence.

So let’s dig into it! To start, understanding coverage is like unlocking a treasure chest. What’s inside can significantly impact your life when the unexpected occurs. Ask yourself: Are you adequately protected? Coverage isn’t just about having a policy; it’s about having the right policy. Consider the life events that could increase your insurance needs. How does your health insurance plan perform when faced with an emergency? Do your auto insurance and home insurance policies offer sufficient protection for your lifestyle?

Once you have the basics down, the next big question is, how do you file a claim when the need arises? Knowing this process can save you time, money, and emotional stress. Imagine the peace of mind knowing exactly which steps to follow, from initial notification to final resolution. Engaging in wireless technology to facilitate claims, such as mobile connectivity and digital downloads, offers a swift path to managing your policies. Have a claim to submit? You might find that many insurers now provide downloadable resources to guide you.

Lastly, let’s look at the role of savings when it comes to insurance. While it may seem counterintuitive, maintaining an adequate emergency fund can contribute to better insurance choices. The next time you think about your premium payments, consider the long-term benefits of having a safety net. After all, financial security isn’t just about insurance; it’s about strategic planning and being proactive, giving you paired assurance in your daily life. Stay informed, stay connected, and keep this guide on hand for easier access to your insurance journey, ensuring you’re always prepared for whatever life throws your way.

Essential Tips for Policyholders: Maximizing Benefits and Savings Across Various Insurance Types

In today’s complex world, understanding insurance can feel as daunting as navigating a labyrinth without a map. Whether you’re looking at health insurance, auto insurance, or home insurance, often the benefits and coverage seem tangled in a web of terms and conditions. But fear not! Policyholders can take specific steps to maximize their benefits and savings, ensuring a more secure financial future. As Benjamin Franklin famously said, 'An ounce of prevention is worth a pound of cure.' With a little preparation, you can streamline your insurance experience and fortify your financial security.

Every insurance policy may seem similar at first glance, but dig a little deeper, and you'll find significant differences. Did you know that choosing the right auto insurance could save you hundreds on premiums annually? Pay attention to your coverage options – liability, comprehensive, and collision coverage are often critical to understanding how--and when--you'll be protected. Plus, exploring available discounts for policyholders, like safe driving or bundling your policies, can translate to substantial savings over time. What are you waiting for? Review your auto insurance policy today and see where you can capitalize on potential savings!

Health insurance is another area where many policyholders overlook opportunities. With the ongoing rise in healthcare costs, having the right coverage is vital. Evaluating your specific needs will help you choose the right plan, be it an HMO, PPO, or HDHP, according to your health requirements. For instance, consider factors like regular doctor visits, prescription needs, and preventive care. More than just a safety net, health insurance is a cornerstone of your overall financial security. As you assess your options, keep an eye out for additional benefits like telehealth services. These cost-effective alternatives to traditional doctor visits can lead to more savings and better health management.

Don’t forget about your home insurance! Often, policyholders overlook this essential component, thinking it’s just a formality. However, it provides protection against damage to your home and personal belongings, and understanding its terms can significantly enhance your benefits. Look for specific coverage options that benefit you, such as additional living expenses in case of a disaster. And here’s a tip: Regularly reviewing your home inventory can help you ensure your coverage limits reflect your belongings' true value. Have you documented all your valuable assets? If not, now is the time!

Finally, let’s not skirt around the importance of term insurance in building financial security. It’s one of the most affordable ways to secure your loved ones' future in case you’re no longer around. Be sure to compare your policy’s premium with its benefits. This allows for a clear grasp of what you're truly getting and how to maximize your savings. If you’re feeling overwhelmed, consider downloading resources from insurance providers, offering a wealth of information on file downloads, digital downloads, and software downloads that could help with your decision-making. Wireless technology can also enable remote access to your policy information, ensuring you have everything you need right at your fingertips. Why not take a moment to hit that subscribe button for instant updates on insurance tips that can transform your coverage experience?

The Digital Age of Insurance: Leveraging Wireless Technology for Seamless Coverage and Claim Filing

The world of insurance is rapidly evolving, and in this digital age, technology is transforming the way we think about coverage and claims. Gone are the days of lengthy phone calls and mountains of paperwork; today, the power of wireless technology enables policyholders to navigate the insurance maze with ease. With mobile connectivity at our fingertips, individuals are now able to manage their insurance policies, from health insurance to auto insurance, in a way that provides both protection and convenience. Have you ever pondered how much easier life could be with just a few taps on your smartphone screen?

Imagine being able to file a claim from the comfort of your home while sipping your morning coffee. Thanks to advancements in telecommunications and data transfer, this is not just a dream but a reality. Wireless communication allows you to submit your claims almost instantaneously, giving you more time to focus on what truly matters. Whether it's a mishap with your car, a health-related concern, or damage to your home, the ability to process these claims digitally enhances your financial security and reduces the stress that often accompanies such events. Why struggle with cumbersome paperwork when you could leverage the benefits of mobile internet?

With the rise of downloadable resources, insurance providers are now offering a plethora of digital downloads that can help you better understand your insurance policies. Whether you're delving into the details of term insurance or exploring options for auto insurance, these resources provide you with the knowledge necessary to make informed decisions. Have you downloaded your insurance provider's app yet? If not, you might be missing out on an invaluable tool designed to streamline your experience and maximize your savings.

For those who have embraced this digital shift, the experience of managing insurance has become more engaging and interactive. Imagine accessing all your policy details from a single app, keeping track of your premiums, and having the power to request changes on-the-go. With wireless downloads, it's possible to transfer your data seamlessly, ensuring that you always have up-to-date information at your fingertips. This level of convenience is not just a luxury; it’s becoming the new standard in the insurance landscape. Isn't it comforting to know that these tools can enhance your overall sense of security in times of need?

The digital age has illuminated the path to a more efficient and user-friendly insurance experience. By adopting modern technology, insurance companies have shifted their focus towards creating relatable and actionable content that empowers policyholders. From easy access to information regarding coverage options to immediate claim filing capabilities, the opportunity for improved financial security is compelling. The combination of wireless technology and user-friendly platforms makes it easier than ever to protect what matters most. So, why not take a leap forward? Explore the world of insurance as it stands today, and unlock the power of mobile connectivity in your financial journey.